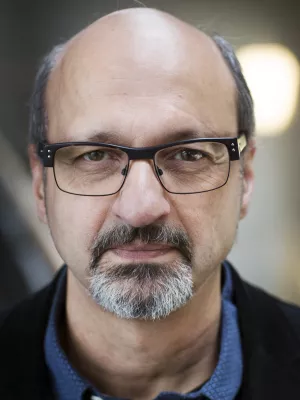

Hossein Asgharian

Professor

Systemic Risk and Centrality Revisited: The Role of Interactions

Författare

Summary, in English

We suggest that banks contribute extensively to systemic risk only if they are both "risky" and centrally placed in the financial network. To calculate systemic risk we apply the CoVaR measure of Adrian and Brunnermeier (2016) and measure centrality using detailed US loan syndication data. In agreement with our conjecture our main finding is that centrality is an important determinant of systemic risk but primarily not by its direct effect. Rather, its main influence is to make other firm specific risk measures more important for highly connected banks. A bank's contribution to systemic risk from a fixed level of Value-at-Risk is about four times higher for a bank with two standard deviations above average centrality compared to a bank with average network centrality. Neglecting this indirect moderation effect of centrality severely underestimates the importance of centrality for "risky" banks and overestimates the effect for "safer" banks.

Avdelning/ar

- Nationalekonomiska institutionen

Publiceringsår

2019

Språk

Engelska

Publikation/Tidskrift/Serie

Working Papers

Issue

2019:4

Länkar

Dokumenttyp

Working paper

Ämne

- Economics

Nyckelord

- systemic risk

- network centrality

- loan syndication

- CoVaR

- G18

- G21

Status

Published