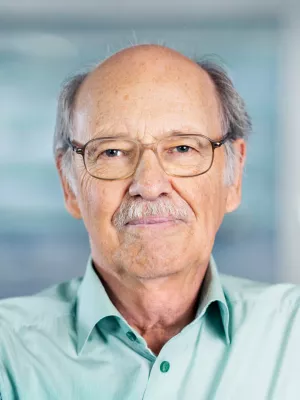

Lars Jonung

Professor emeritus

Iceland Should Replace Its Central Bank with a Currency Board.

Författare

Redaktör

- Robert Z. Aliber

- Gylfi Zoega

Summary, in Swedish

Avdelning/ar

- Nationalekonomiska institutionen

Publiceringsår

2019-06-10

Språk

Engelska

Sidor

349-349

Publikation/Tidskrift/Serie

The 2008 Global Financial Crisis in Retrospect. : Causes of the Crisis and National Regulatory Responses

Länkar

Dokumenttyp

Del av eller Kapitel i bok

Förlag

Palgrave Macmillan

Ämne

- Economics

Nyckelord

- iceland

- monetary policy

- currency board

- Financial Crisis

- iceland

- monetary policy

- currency board

- finacial crisis

Status

Published