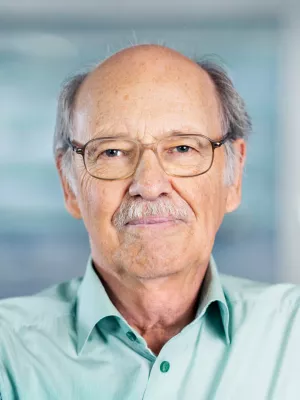

Lars Jonung

Professor emeritus

Lessons from the Swedish experience with negative central bank rates.

Författare

Summary, in English

Negative interest rates were once seen as impossible outside the realm of economic theory. However, several central banks have recently adopted negative policy rates. The Federal Reserve is coming under increasing pressure to follow suit in the wake of the coronavirus crisis. This paper investigates the actual effects of negative interest rates using the Swedish experience from 2015 to 2019. The Swedish Riksbank was one of the first central banks to introduce a negative interest rate in 2015 and the first central bank to abandon a negative rate in 2019. We find that negative rates had a modest effect on consumer price inflation due to globalization, but significant effects on the exchange rate and domestic asset prices, thus fostering financial imbalances. We conclude by discussing the implications of our results for larger economies such as the United States. Our view is that the lesson from Sweden is clear: a negative central bank polity rate is not a panacea.

Avdelning/ar

- Nationalekonomiska institutionen

Publiceringsår

2020-11-16

Språk

Engelska

Publikation/Tidskrift/Serie

Cato Journal

Volym

40

Issue

3

Länkar

Dokumenttyp

Artikel i tidskrift

Förlag

Cato Institute, Washington, DC

Ämne

- Economics

Nyckelord

- negative interest rates

- monetary policy

- central banks

- Riksbank

- Sweden

- financial crisis

- covid19

Status

Published

ISBN/ISSN/Övrigt

- ISSN: 0273-3072